No one ever plans on having health issues. We are all just going about our business, living our day to day lives and out of no where it can seem like everything is teetering on the edge of a very tall cliff. The way down is one jagged cliff after another featuring anxiety, fear, surgery, hospitalization, doctors visits, co-pays and prescriptions. Meanwhile we’re all still trying to wrap our head around the fact that we were healthy human beings just 5 minutes ago.

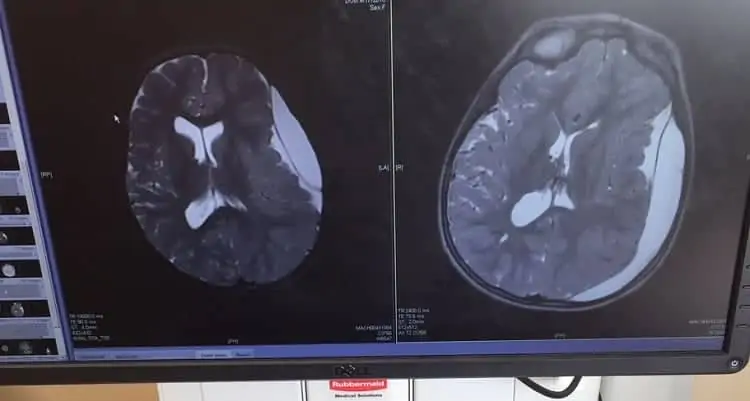

That’s exactly how we felt the moment we found out our daughter would require a shunt placed in her brain. The amount of information we were required to process in a short matter of time seemed insurmountable.

Luckily, we had a very knowledgable case worker guiding us through the process. Today I received a Summary of Benefits from our insurance company and just part of my daughters surgery and hospital stay quickly amounted to over $9,000. My out of pocket expense? $0.00. While we’re fortunate to have excellent insurance, had we made a mis-step in the preparation process, we would have been staring down the barrel end of that sum and fighting a nightmare to get out of it. Having been through the process ourselves, there are few things you should do as soon as possible when dealing with a costly health crisis.

Financial Steps to Take When a Health Crisis Strikes

Speak with a Case Worker

Your doctors office or hospital should be able to put you in touch a knowledgeable caseworker who can help guide you through the financial process.

Contact Your Insurance Company

As with our case, we needed a referral from my daughters primary care physician in order to see the Neurologist. Once that relationship was established, all decisions made by the neurologist were were covered under that referral. When speaking with your insurance company make sure that you know the details of the procedure, your physician and the hospital where it will take place. If you are not assigned a physician or hospital, see who is available in your coverage network.

Speak With Your Physician and Hospital

If your physician and hospital know you are worried about the financial burden they’re able to work with you from the very beginning. Even decisions like going with generic brand prescriptions versus name brand can save you money over time.

Keep Records of all Bills and Payments

In addition to paying your medical bills, there are services and loopholes you can use to lower your payments. For instance, many hospitals and doctors offices will work with you on large bills. You can also write off some medical expenses during tax preparation.

Speak with An Accountant/Your Tax Preparation Service

Did you know that medical expenses may qualify as a tax write off? Should you be billed for medical care your accountant or tax preparation service will be able to guide you in writing off any eligible amounts.

By taking these steps you will hopefully be able to navigate yourself safely down the crisis cliff as did. Like us and nearly 80% of taxpayers, reporting our health insurance this year again will be as easy as checking a box with TurboTax. Taxpayers who have insurance through an employer, government program, such as Medicare or Medicaid, or other private insurance may receive a 1095-B or C form. You do not need these forms to report insurance and file taxes – they are for your records only. But not to worry, TurboTax offers a free suite of tools to help people understand how the ACA will affect their taxes. Additionally, TurboTax doesn’t charge tax payers any extra fees for health care-related forms to comply with the ACA.

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.

This is always something to think about and be prepared for. Great tips on how to be prepared.